In one call we will give you all the information you need to make an informed choice of payment provider/prices. No sales spiel, No call centres, just the facts you need to know

Card Payment Advice

Card Machines

Credit card machines, card readers and PDQs are quickly becoming the defacto way to pay at face-to-face point-of-sale in most outlets across the UK

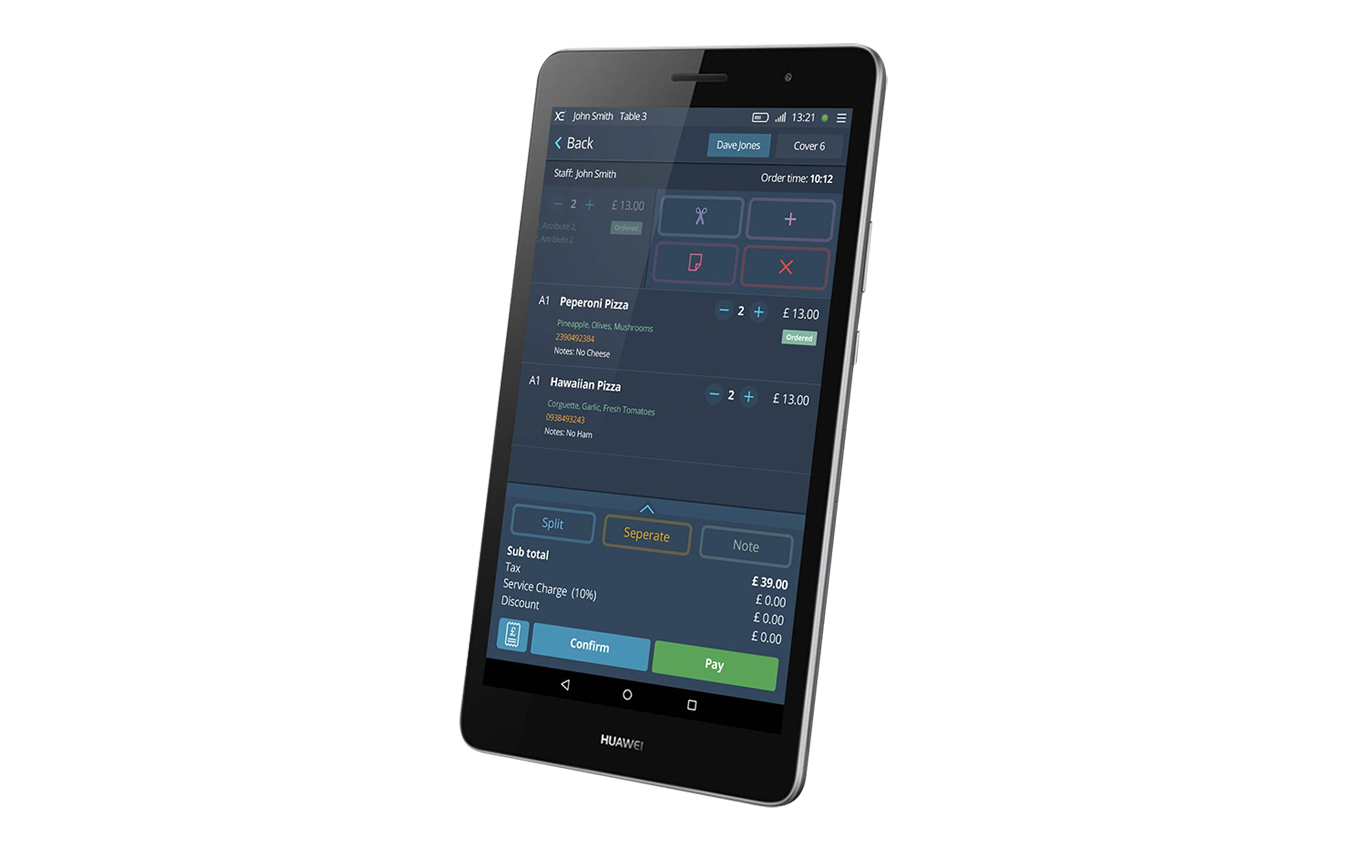

EPOS Systems

The world’s most effective retail EPOS solution. Simple, efficient and powerful. Make the most out of our easy to use user interface.

Sales Analytics

Electronic payments systems with order management, stock control and advanced sales analytics at your fingertips.

Card Payment Advice

Processing card payments is a vital function for countless businesses worldwide. Whether completing a sale online or charging a customer’s card in-store, the customer’s action takes only a few seconds yet so much more is going on in the background! Accepting card payments is a risky process – the card details provided could be stolen, fraudulent, or simply unable to cover the costs of the purchase! Because processing the payment involves a delay, credit is issued by the bank during the interim period, which means if the paying account doesn’t cover the funds, the credit will be withdrawn, and the business will receive nothing! Here’s how card processing works to prevent that from happening:

Authorisation

During the authorisation stage, the customer will submit the card payment online or in-store by swiping their card, initiating the process. Following this, the website or card terminal will encrypt the card details to communicate them with the bank which holds the merchant account. The bank will then send the details on to the card provider, like VISA or Mastercard, which will verify the information and request that the customer’s bank approve the payment.

Authentication

Once the card details have been verified and the payment is approved, it’s time to authenticate the purchase to release the payment. This requires the issuing bank to notify the card provider, which in turn notifies the acquiring bank! Finally, a hold is placed on the payer’s account for the amount requested, which will become a withdrawal once the payment is cleared.

Settlement

Once all the legwork is complete, the issuing bank can release the funds to the acquiring bank. This can take several days, which is why your bank account may not update immediately! This process is usually started at the end of the day when the retailer cashes out and sends their daily batch of card payments to be finalised. Settling each transaction individually, the issuing bank will transfer the funds to the credit card network, which will send them to the acquiring bank. Finally, the acquiring bank will deposit the funds into the merchant’s account and the issuing bank will complete the payment from the customer’s account to update their available balance.

Merchant Accounts for Cryptocurrency

We offer unparalleled access to a range of payment service providers eager to work with businesses providing buy and sell ramps, and merchants taking digital payments.